The Company is a leading engineering and infrastructure company with expertise across diverse sectors, including water, power, roads, and hydrocarbons. The company has demonstrated expertise in executing large-scale projects for both public and private clients, adhering to stringent technical standards and timelines. Its operations contribute to key infrastructure developments across the country.

The Company sought to enter the Steel industry in India. One method identified was to bid for a major public sector enterprise in the industry, which was undergoing disinvestment by the Government of India. Primus Partners worked with the Company through the entire transaction process and Go to Market strategy in the Steel space.

Our Approach

Primus Partners undertook comprehensive due-diligence on the target company, involving in-depth financial, operational and legal due-diligence. Key areas of support involved:

- Assessing the strategic fit for the investment by a market analysis of historical growth, size of the market and future growth potential

- Understanding and analyzing the competitive landscape, key players, their growth trajectory and target positioning

- Conducting regulatory analysis and highlighting any changes in policy making over the short term

- Preparing a detailed business case for the investment basis the market, competitive and regulatory landscape

- Carrying out a full technical and operational survey of the target company plant and assessing investments for restarting and evaluated associated risks

- Preparing a detailed business plan and validating the financial model for 5 years with focus on product mix and customer

- Deriving the DCF method of valuation basis the business plan and market comparable multiples

- The team arrived at a valuation of INR 10,000 crore for the bid transaction basis our research, consultation and modelling

- Preparing a viewpoint on valuation multiple and structuring of deal

- Correlating financial due diligence findings with client valuations and price negotiations

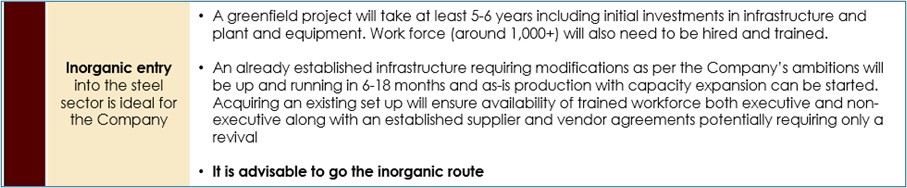

Primus advised the client on various methods to enter the steel market, identifying ‘Inorganic’ expansion via acquisition as the best opportunity to get a strong footing in the industry.

The team deployed multiple frameworks to arrive at the product mix which the Company should expand in basis market size, margins, competitions and the target’s synergy with the Company.

The Benefits

- The Company gained a clear strategic understanding of entering the steel sector in India

- Primus enabled the Company to identify the most advantageous approach to establishing a foothold in the industry

- The Company was able to network and partners with relevant industry stakeholders via Primus’s support

- The Company established a strong reputation as a new entrant in the industry in a short time.